FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

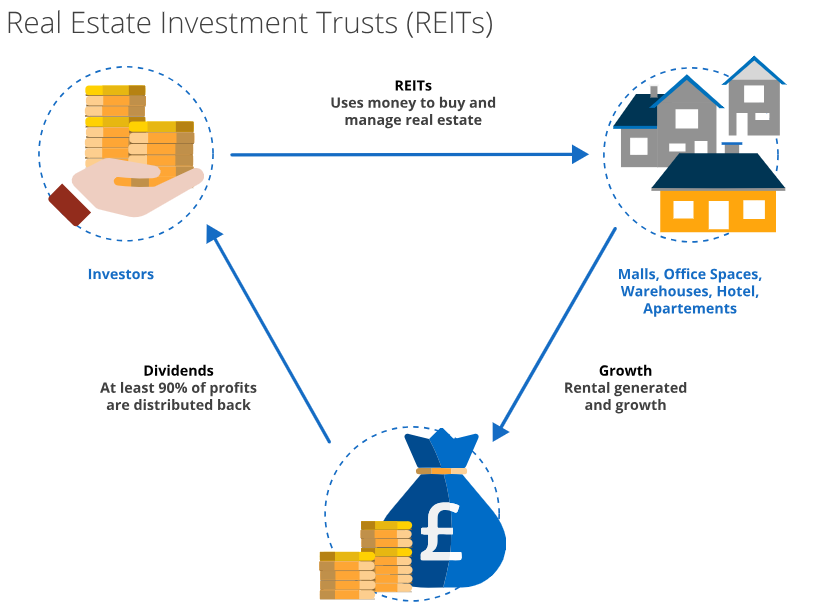

Real Estate Investment Trust (REIT) owns and/or manages real estate properties to generate income through capital appreciation and rental income. Similar to mutual funds, REITs collect money from many investors and invest it in income-producing real estate properties such as malls, office spaces, industrial parks, warehouses, etc. They lease or rent out properties and collect rental income in return, which in turn is distributed to investors as dividends.

REITs are an investment vehicle that allows retail investors to have proportionate ownership in yield-driving real estate assets. Therefore, individuals who wish to invest in real estate but do not have a large capital to purchase real estate properties can invest through REITs. All REITs in India are regulated by the SEBI Real Estate Investment Trust Regulations 2014.

Investors can invest in REITs by applying for the IPO or buying REIT units directly from the exchange, once the REIT is listed. As of May 2023, there are a total of 3 REITs listed in India. Embassy Office Parks REIT is the first listed REIT in India followed by Mindspace Business Parks REIT and Brookfield India REIT. Nexus Select Trust is India’s first retail REIT IPO.

If you want to invest in REIT IPO, read all about REITs including the types of REITs, the requirements for setting up a REIT, how REITs are taxed, and the pros and cons of REIT investment.

REITs or Real Estate Investment Trusts are companies that own, operate and manage income-driving real estate properties. The assets of REIT include industrial parks, shopping malls, hospitality, office buildings, warehouses, apartment complexes, resorts, data centers, healthcare facilities, retail centers, etc.

REITs are the best investment option that offers investors the opportunity to invest in real estate assets to earn income in the form of dividends. In this way, investors enjoy capital appreciation while generating income.

There are 3 types of REITs that are popular in India, depending on the type of REIT business;

Real estate companies and REITs are different because REITs acquire, develop and finance real estate properties as an investment portfolio, while real estate companies are primarily engaged in the development and resale of real estate assets.

To establish a Real Estate Investment Trust, the real estate company becomes the REIT sponsor and must appoint a trustee to hold all assets in Trusteeship. Thus, the assets are under the direct control of the trust and not the sponsor. The REIT controls the real estate assets either directly or through the establishment of a special purpose vehicle (SPV), a domestic corporation that holds the real estate properties on behalf of REIT. According to the regulations, REIT must hold at least 50% stake in the SPV.

A real estate company that meets the following conditions set by SEBI is eligible to establish REIT;

Once REITs are registered with the Security and Exchange Commission (SEC), they can go public through an Initial Public Offering (IPO). REIT IPO refers to the initial share sale offering of a REIT for public subscription. An IPO of REIT allows investors to invest in high-priced real estate properties.

REITs are permitted to launch IPO if the following conditions are satisfied;

One can invest in REIT by either applying for REIT IPO or investing through the stock exchange after the shares are listed.

Investors can easily park their money by applying for REIT IPO. To invest in the REIT IPO, it is mandatory to have a demat and trading account with any stock broker. You can place an IPO order during the period REIT is open for subscription. On July 30 2021, the market regulator SEBI reduced the minimum subscription size for REITs from Rs 50,000 to Rs 10,000 to 15,000.

Once shares of Real-Estate Investment Trusts are listed on the stock exchange, they will be publicly traded REIT. Other REITs that are registered with SEBI but have not yet issued shares in the market are referred to as unlisted or non-traded REIT.

If you have not received the REIT share allotment, you can buy REIT units directly from the stock exchange after listing. The price of REIT shares fluctuates constantly depending on supply and demand.

If you do not have a Demat account, open an account with India's number 1 discount broker

Now the question arises as to how income from REIT IPO is taxed in the hands of investors Taxation at REIT works differently depending on the type of income, be it interest, dividend income, or capital gains.

| Capital Gain Tax | Tax Rate |

| Short-term capital gain tax | If an investor sells REIT shares within 3 years or 36 months, the proceeds will be taxed at 15% STCG tax. |

| Long-term capital gain tax | If an investor books profits by selling REIT units after 36 months, the gain in excess of the Rs 1 Lakh threshold will be taxed at a rate of 10% LTCG. |

Below are the main advantages and limitations/disadvantages of investing in real estate investment trusts;

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

As per SEBI notification dated July 21, the minimum investment amount for REIT is between Rs 10,000 to Rs 15,000. Earlier, investors had to invest at least Rs 50,000 in REITs. The regulation has also reduced the minimum lot size for trading in REIT from 100 units to 1 unit.

Listed REITs can be traded on designated exchanges. Just like equity stocks, you can buy and sell REIT shares directly on the BSE and NSE exchanges. As per the SEBI&rsquo's norms, investors can purchase even one unit of REIT shares from the stock exchange.

Investment in REIT is not risk-free and subject to the following risks;

Investment in REITs brings the following advantages;

After the incorporation of REIT and the appointment of the manager and compliance officers, the sponsor can submit a registration application on the SEBI Intermediary Portal (SI Portal). REITs are required to pay a fee of Rs 1 Lakh while applying for registration. Once all the conditions for registration are fulfilled on REIT, SEBI will send an intimation through the SI portal. To obtain a registration certificate, the applicant has to pay a one-time registration fee of Rs 10 Lakh.